Prior to and during most of the 19th century, international trade was denominated in terms of currencies that represented weights of gold. Most national currencies at the time were in essence merely different ways of measuring gold weights (much as the yard and the meter both measure length and are related by a constant conversion factor). Hence some assert that gold was the world's first global currency. The emerging collapse of the international gold standard around the time of World War I had significant implications for global trade.

Pound sterling

Before 1944, the world reference currency was the United Kingdom's pound sterling. The transition between pound sterling and United States dollar and its impact for central banks was described recently.[3]U.S. dollar

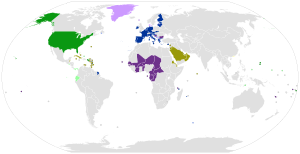

Worldwide use of the euro and the US$

United States

External adopters of the US dollar

Currencies pegged to the US dollar

Currencies pegged to the US dollar w/ narrow band

External adopters of the euro

Currencies pegged to the euro

Currencies pegged to the euro w/ narrow band

The Belarusian ruble is pegged to the euro, Russian ruble and U.S. dollar in a currency basket.Since the collapse of the fixed exchange rate regime and the gold standard and the institution of floating exchange rates following the Smithsonian Agreement in 1971, most currencies around the world have no longer been pegged against the United States dollar. However, as the United States was and remains the world's preeminent economic superpower, most international transactions continued to be conducted with the United States dollar, and it has remained the de facto world currency. According to Robert Gilpin in Global Political Economy: Understanding the International Economic Order (2001): "Somewhere between 40 and 60 percent of international financial transactions are denominated in dollars. For decades the dollar has also been the world's principal reserve currency; in 1996, the dollar accounted for approximately two-thirds of the world's foreign exchange reserves", as compared to about one-quarter held in euros (see Reserve Currency).

Some of the world's currencies are still pegged against the dollar. Some countries, such as Ecuador, El Salvador, and Panama, have gone even further and eliminated their own currency (see dollarization) in favor of the United States dollar.

Only two serious challengers to the status of the United States dollar as a world currency have arisen. During the 1980s, the Japanese yen became increasingly used as an international currency,[citation needed] but that usage diminished with the Japanese recession in the 1990s. More recently, the euro has increasingly competed with the United States dollar in international finance.

Euro

The euro inherited its status as a major reserve currency from the German mark (DM) and its contribution to official reserves has increased as banks seek to diversify their reserves and trade in the eurozone expands.[4]As with the dollar, some of the world's currencies are pegged against the euro. They are usually Eastern European currencies like the Bulgarian lev, plus several west African currencies like the Cape Verdean escudo and the CFA franc. Other European countries, while not being EU members, have adopted the euro due to currency unions with member states, or by unilaterally superseding their own currencies: Andorra, Monaco, Kosovo, Montenegro, San Marino, and Vatican City.

As of December 2006, the euro surpassed the dollar in the combined value of cash in circulation. The value of euro notes in circulation has risen to more than €610 billion, equivalent to US$800 billion at the exchange rates at the time (today equivalent to circa US$968 billion).[

Russian President Dmitry Medvedev Unveils New World Currency

Russia's

President, Dmitry Medvedev (pictured left), pulled the world's new

currency from his pocket at the meeting of G8 leaders in the Italian

city of Aquila. The future of the dollar was one of several subjects

debated at the G8 summit. Mr. Medvedev, who has been seeking ways to

displace the dollar as the world's dominant reserve currency, produced a

sample coin of what he described as a 'united future world currency'.

"Here it is," Mr. Medvedev said, according to Bloomberg. "You can see it

and touch it." The coin, which was minted in Belgium, was presented to

all the G8 leaders attending the summit and bears the words 'unity in

diversity.' The possibility of a supranational currency "concerns

everyone now, even the mints," Mr. Medvedev said. The test coin "means

they're getting ready. I think it's a good sign that we understand how

interdependent we are." – Telegraph

Dominant Social Theme: Alternative currencies are OK.

Free-Market Analysis: How do you write about what may be the new world currency without mentioning "gold." You write the article without using the word. You call it currency – even though it is specie – and you describe it as being minted. But you never call it gold. Way to go, Telegraph. Interesting article anyway.

We have stated within the pages of our slim volume on a number of occasions that were non-Western countries serious about producing an alternative currency, they would back it with gold. Apparently, Medvedev has gone one step further and is hinting at putting gold back into circulation. Wow.

Actually, it wasn't Medvedev's idea to create the coin, but someone named Sandro Sassoli, an Italian journalist who had the idea back 1996, apparently. Hard to find much about him.

OK, who knows if this is a threat or the start of a real alternative currency. Somehow we can't quite fathom that gold would be produced as currency, especially given that China has been part of this movement for a new money and China owns a trillion or so US paper dollars. But we have no doubt that China and Russia both are serious about the dollar's plight. And they don't want to see it debased. Here's what Chron.com had to say about the coin last week:

The coins ... are called "eurodollars," in a symbolic call for a common currency to unite Europe and the United States. They have a value of euro 2,800 ($3,900) and were produced by the United Future World Currency, a group pushing the idea of a global currency. The works will go to the leaders of the Group of Eight industrialized countries as well as to the President of the European Council Fredrik Reinfeldt and EU Commission President Jose Manuel Barroso. The Group of Eight is Canada, France, Germany, Italy, Japan, Russia, the United Kingdom and the United States.

That said, Medvedev et. al. seem to be getting the right idea. If they want to end currency debasement and endless arguments over the efficacy and role of central banks, the solution is simple. Coin gold and silver and watch the market go to work.

Dominant Social Theme: Alternative currencies are OK.

Free-Market Analysis: How do you write about what may be the new world currency without mentioning "gold." You write the article without using the word. You call it currency – even though it is specie – and you describe it as being minted. But you never call it gold. Way to go, Telegraph. Interesting article anyway.

We have stated within the pages of our slim volume on a number of occasions that were non-Western countries serious about producing an alternative currency, they would back it with gold. Apparently, Medvedev has gone one step further and is hinting at putting gold back into circulation. Wow.

Actually, it wasn't Medvedev's idea to create the coin, but someone named Sandro Sassoli, an Italian journalist who had the idea back 1996, apparently. Hard to find much about him.

OK, who knows if this is a threat or the start of a real alternative currency. Somehow we can't quite fathom that gold would be produced as currency, especially given that China has been part of this movement for a new money and China owns a trillion or so US paper dollars. But we have no doubt that China and Russia both are serious about the dollar's plight. And they don't want to see it debased. Here's what Chron.com had to say about the coin last week:

The coins ... are called "eurodollars," in a symbolic call for a common currency to unite Europe and the United States. They have a value of euro 2,800 ($3,900) and were produced by the United Future World Currency, a group pushing the idea of a global currency. The works will go to the leaders of the Group of Eight industrialized countries as well as to the President of the European Council Fredrik Reinfeldt and EU Commission President Jose Manuel Barroso. The Group of Eight is Canada, France, Germany, Italy, Japan, Russia, the United Kingdom and the United States.

That said, Medvedev et. al. seem to be getting the right idea. If they want to end currency debasement and endless arguments over the efficacy and role of central banks, the solution is simple. Coin gold and silver and watch the market go to work.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.